I am caught in the tax below as a satellite family except that we are a canadian satellite family not what the term generally means in the bc real estate world i e.

Satellite family definition bc.

1 for canadian citizens and permanent residents who don t live in bc.

An individual s income is combined with their spouse s income for.

I am currently an alberta resident but i have owned property in bc as a vacation home since 2006.

For example a family member living in bc with an income earning spouse residing outside of bc.

0 5 for canadian citizens and permanent residents who live in bc who are not a.

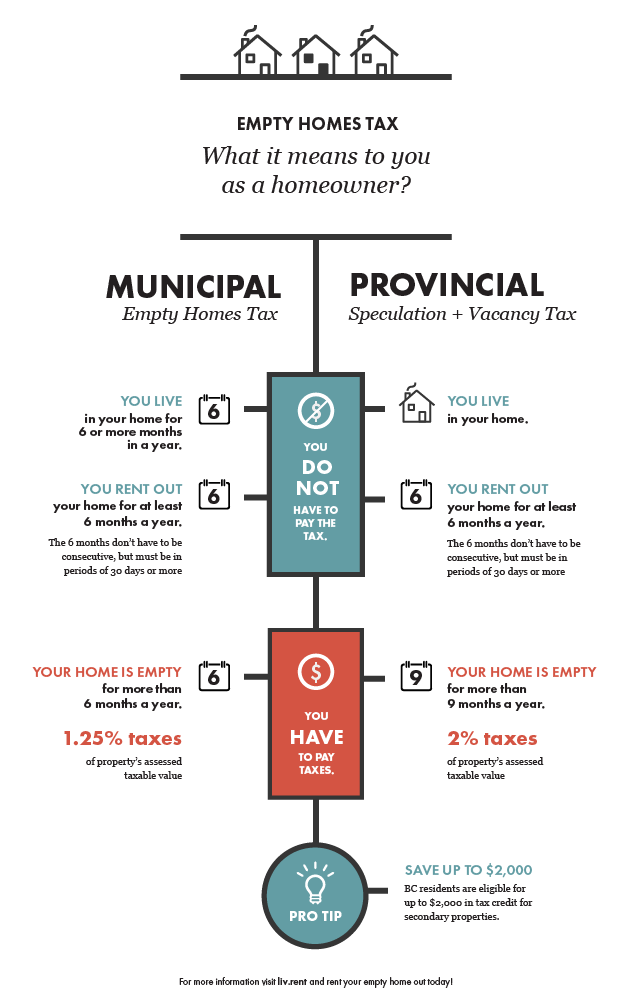

2 for foreign owners and satellite families 0 5 for british columbians and other canadian citizens or permanent residents who are not members of a satellite family the speculation and vacancy tax applies based on ownership as of december 31 each year.

What is the definition of a satellite family.

Wealthy investors from outside the country.

The bc government will be collecting information from homeowners to identify families with high worldwide income known as satellite families.

As an example you may have a resident spouse and perhaps a non resident spouse and the non resident individual is the main income earner in the family.

A so called satellite family from china involved in immigration fraud who bought a multimillion dollar mansion in west vancouver after immigrating to canada through the quebec investor program are to be deported after a judge threw out the judicial review of their removal order.

A satellite family has been defined so far as one with a high worldwide income but low bc income.

Rates for 2019 and onwards will be 2 for foreign investors and what the government refers to as satellite families see the term s description below 1 for canadian citizens and permanent residents who do not live full time in bc and 0 5 for british columbians who are canadian citizens or permanent residents and not members of a.

A satellite family is defined as afamily where less than 50 of the combined household income is taxed in canada on canadian income tax returns of course.

These satellite families will not be eligible for principal residence exemption from the speculation tax.

Owners who are part of a satellite family are taxed at the 2 rate.

To help bc taxpayers a non refundable tax credit of 2 000 00 will be applied directly to the spec tax bill.